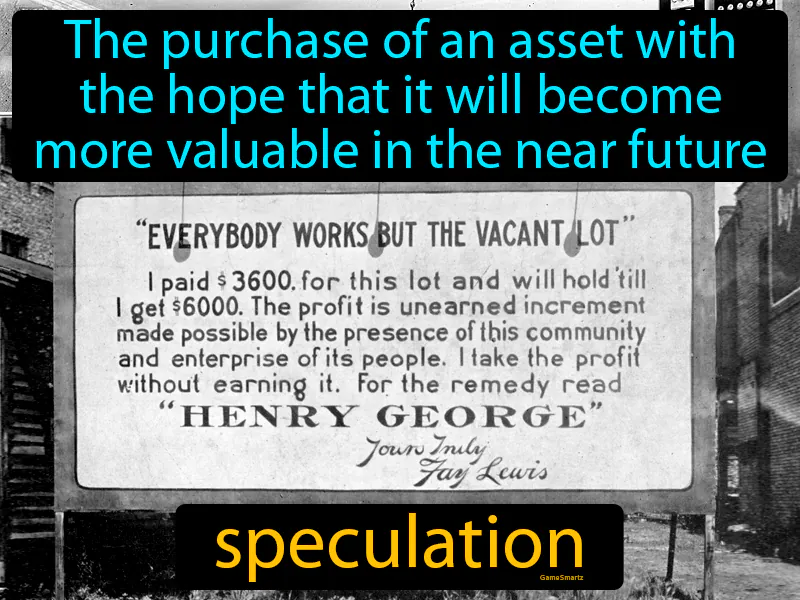

Speculation

Speculation: Easy to understand

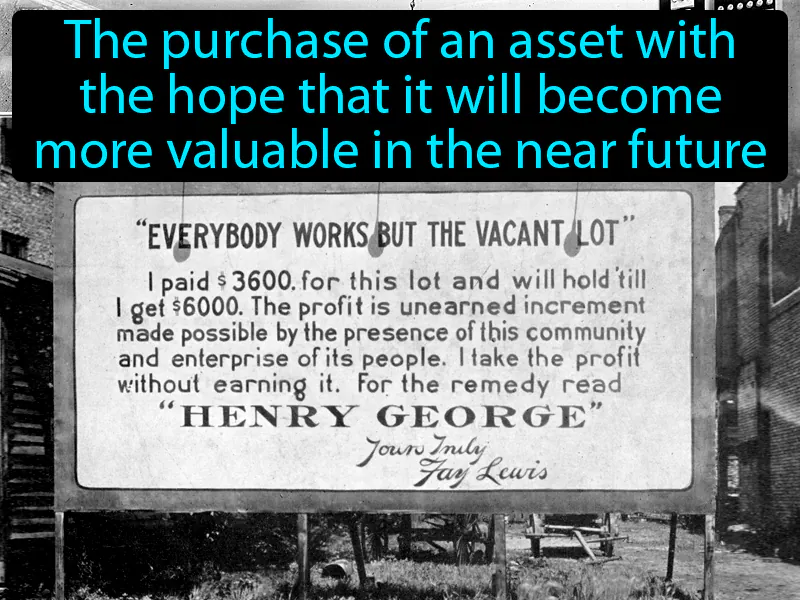

During the late 1920s, speculation was rampant as people invested heavily in the stock market, hoping to gain quick profits as stock prices soared. This behavior contributed to the stock market crash of 1929, a key factor that led to the Great Depression, a time of severe economic hardship. Speculation was fueled by the idea that stock prices would keep rising, but when they didn't, it caused massive financial losses and economic instability. Today, speculation remains relevant, as people often invest in assets like real estate or cryptocurrencies, hoping their value will increase quickly. For example, if someone buys a house in a rapidly developing area expecting its value to rise, they are speculating, but if the market changes, they could face financial loss.

Practice Version

Speculation: The purchase of an asset with the hope that it will become more valuable in the near future. Speculation. In history, speculation refers to risky financial actions, like those leading to the 1929 stock market crash.